Em posts recentes, ensinamos diversas técnicas de trading utilizando o Python, bem como também mostramos como utilizar o MetaTrader5 para a importação de dados de ativos financeiros e a realização de requisições de ordem e venda com a linguagem. No post de hoje, estaremos interessados em criar um ambiente automatizado, que pretende criar as requisições de acordo com os sinais de um sistema de trading em tempo real.

O objetivo será criar um ambiente totalmente automatizado, portanto, será necessário usar diversas opções de funções e métodos disponíveis na biblioteca MetaTrader 5 do Python, de forma que atenda os principais requisitos de criação de ordem e venda.

Iremos criar esse ambiente em uma classe definida com diversas funções em um arquivo .py. Após isso, utilizaremos um arquivo .ipnyb para definir o indicador utilizado, no caso, o RSI, para definir as ordens de compra e venda. Os dois arquivos são separados pelos blocos de código abaixo.

import MetaTrader5 as mt5

import pandas as pd

import numpy as np

from datetime import datetime

class MT5:

max_price = dict()

min_price = dict()

summary = None

def get_ticks(symbol, number_of_data = 10000):

# Data e horário atual

from_date = datetime.now()

# Extrai os ticks (instrumentos financeiros)

ticks = mt5.copy_ticks_from(symbol, from_date, number_of_data, mt5.COPY_TICKS_ALL)

# Transforma a tupla em data frame

df_ticks = pd.DataFrame(ticks)

# Converte a data em datetime

df_ticks["time"] = pd.to_datetime(df_ticks["time"], unit="s")

# Coloca a data no index

df_ticks = df_ticks.set_index("time")

return df_ticks

def get_rates(symbol, number_of_data = 10000, timeframe=mt5.TIMEFRAME_D1):

# Cria a data atual

from_date = datetime.now()

# Extrai os ticks (instrumentos financeiros)

rates = mt5.copy_rates_from(symbol, timeframe, from_date, number_of_data)

# Transforma a tupla em data frame

df_rates = pd.DataFrame(rates)

# Converte a data em datetime

df_rates["time"] = pd.to_datetime(df_rates["time"], unit="s")

# Coloca a data no index

df_rates = df_rates.set_index("time")

return df_rates

def risk_reward_threshold(symbol, buy=True, risk=0.01, reward=0.02):

# Extrai o leverage (alavancagem)

leverage = mt5.account_info().leverage

# Computa o preço

price = mt5.symbol_info(symbol).ask

# Extrai o número de decimais

nb_decimal = str(price)[::-1].find(".")

# Computa as variação em porcentagem

var_down = risk/leverage

var_up = reward/leverage

# Acha o limite do TP e SL em preço absoluto

if buy:

price = mt5.symbol_info(symbol).ask

# Computa as variações em preço absoluto

price_var_down = var_down*price

price_var_up = var_up * price

tp = np.round(price + price_var_up, nb_decimal)

sl = np.round(price - price_var_down, nb_decimal)

else:

price = mt5.symbol_info(symbol).bid

# Computa as variações em preço absoluto

price_var_down = var_down*price

price_var_up = var_up * price

tp = np.round(price - price_var_up, nb_decimal)

sl = np.round(price + price_var_down, nb_decimal)

return tp, sl

def find_filling_mode(symbol):

for i in range(2):

request = {

"action": mt5.TRADE_ACTION_DEAL,

"symbol": symbol,

"volume": mt5.symbol_info(symbol).volume_min,

"type": mt5.ORDER_TYPE_BUY,

"price": mt5.symbol_info_tick(symbol).ask,

"type_filling": i,

"type_time": mt5.ORDER_TIME_GTC}

result = mt5.order_check(request)

if result.comment == "Feito":

break

return i

def send_order(symbol, lot, buy, sell, id_position=None, pct_tp=0.02, pct_sl=0.01, comment=" No specific comment", magic=0):

# Inicializa o mt5 com o Python

mt5.initialize()

# Extrai o filling_mode

filling_type = MT5.find_filling_mode(symbol)

""" ABRE O TRADE """

if buy and id_position==None:

tp, sl = MT5.risk_reward_threshold(symbol, buy=True, risk=pct_sl, reward=pct_tp)

request = {

"action": mt5.TRADE_ACTION_DEAL,

"symbol": symbol,

"volume": lot,

"type": mt5.ORDER_TYPE_BUY,

"price": mt5.symbol_info_tick(symbol).ask,

"deviation": 10,

"tp": tp,

"sl": sl,

"magic": magic,

"comment": comment,

"type_filling": filling_type,

"type_time": mt5.ORDER_TIME_GTC}

result = mt5.order_send(request)

print(mt5.symbol_info_tick(symbol).ask, tp, sl)

return result

if sell and id_position==None:

tp, sl = MT5.risk_reward_threshold(symbol, buy=False, risk=pct_sl, reward=pct_tp)

request = {

"action": mt5.TRADE_ACTION_DEAL,

"symbol": symbol,

"volume": lot,

"type": mt5.ORDER_TYPE_SELL,

"price": mt5.symbol_info_tick(symbol).bid,

"deviation": 10,

"tp": tp,

"sl": sl,

"magic": magic,

"comment": comment,

"type_filling": filling_type,

"type_time": mt5.ORDER_TIME_GTC}

result = mt5.order_send(request)

print(mt5.symbol_info_tick(symbol).bid, tp, sl)

return result

""" FECHA O TRADE """

if buy and id_position!=None:

request = {

"position": id_position,

"action": mt5.TRADE_ACTION_DEAL,

"symbol": symbol,

"volume": lot,

"type": mt5.ORDER_TYPE_SELL,

"price": mt5.symbol_info_tick(symbol).bid,

"deviation": 10,

"magic": magic,

"comment": comment,

"type_filling": filling_type,

"type_time": mt5.ORDER_TIME_GTC}

result = mt5.order_send(request)

return result

if sell and id_position!=None:

request = {

"position": id_position,

"action": mt5.TRADE_ACTION_DEAL,

"symbol": symbol,

"volume": lot,

"type": mt5.ORDER_TYPE_BUY,

"price": mt5.symbol_info_tick(symbol).ask,

"deviation": 10,

"magic": magic,

"comment": comment,

"type_filling": filling_type,

"type_time": mt5.ORDER_TIME_GTC}

result = mt5.order_send(request)

return result

def resume():

""" Retorna as posições atuais. Posição=0 --> Compra """

# Define o nome das colunas que serão criadas

colonnes = ["ticket", "position", "symbol", "volume", "magic", "profit", "price", "tp", "sl","trade_size"]

# Pega as posições em aberto

liste = mt5.positions_get()

# Cria um dataframe vazio

summary = pd.DataFrame()

# Cria o loop para adicionar cada linha no dataframe

for element in liste:

element_pandas = pd.DataFrame([element.ticket, element.type, element.symbol, element.volume, element.magic,

element.profit, element.price_open, element.tp,

element.sl, mt5.symbol_info(element.symbol).trade_contract_size],

index=colonnes).transpose()

summary = pd.concat((summary, element_pandas), axis=0)

try:

summary["profit %"] = summary.profit / (summary.price * summary.trade_size * summary.volume)

summary = summary.reset_index(drop=True)

except:

pass

return summary

def trailing_stop_loss():

# Extrai as posições abertas atuais

MT5.summary = MT5.resume()

# Verificaçã: Tem alguma posição em aberto?

if MT5.summary.shape[0] >0:

for i in range(MT5.summary.shape[0]):

# Extrai as informação

row = MT5.summary.iloc[i]

symbol = row["symbol"]

""" CASO 1: Altera dinâmicamente o stop loss para uma ORDEM DE COMPRA """

# Trailing stop loss para um posição de compra

if row["position"] == 0:

if symbol not in MT5.max_price.keys():

MT5.max_price[symbol]=row["price"]

# Extrai o preço atual

current_price = (mt5.symbol_info(symbol).ask + mt5.symbol_info(symbol).bid ) / 2

# Computa a distância entre o preço atual e preço máximo

from_sl_to_curent_price = current_price - row["sl"]

from_sl_to_max_price = MT5.max_price[symbol] - row["sl"]

# Se o preço atual é maior que o preço máximo anterior --> novo preço máximo

if current_price > MT5.max_price[symbol]:

MT5.max_price[symbol] = current_price

# Encontra a diferença entre a diferença do preço menor e máximo

if from_sl_to_curent_price > from_sl_to_max_price:

difference = from_sl_to_curent_price - from_sl_to_max_price

# Seta filling mode

filling_type = mt5.symbol_info(symbol).filling_mode

# Seta o point

point = mt5.symbol_info(symbol).point

# Altera o sl

request = {

"action": mt5.TRADE_ACTION_SLTP,

"symbol": symbol,

"position": row["ticket"],

"volume": row["volume"],

"type": mt5.ORDER_TYPE_BUY,

"price": row["price"],

"sl": row["sl"] + difference,

"type_filling": filling_type,

"type_time": mt5.ORDER_TIME_GTC,

}

information = mt5.order_send(request)

print(information)

""" CASO 2: Altera dinâmicamente o stop loss para uma ORDEM DE VENDA """

# Trailing stop loss para uma ordem de venda

if row["position"] == 1:

if symbol not in MT5.min_price.keys():

MT5.min_price[symbol]=row["price"]

# Extrai o preço atual

current_price = (mt5.symbol_info(symbol).ask + mt5.symbol_info(symbol).bid ) / 2

# Computa a distância entre o preço atual e preço máximo

from_sl_to_curent_price = row["sl"] - current_price

from_sl_to_min_price = row["sl"] - MT5.min_price[symbol]

# Se o preço atual é maior que o preço máximo anterior --> novo preço máximo

if current_price < MT5.min_price[symbol]:

MT5.min_price[symbol] = current_price

# Encontra a diferença entre a diferença do preço menor e máximo

if from_sl_to_curent_price > from_sl_to_min_price:

difference = from_sl_to_curent_price - from_sl_to_min_price

# Seta filling mode

filling_type = mt5.symbol_info(symbol).filling_mode

# Seta o point

point = mt5.symbol_info(symbol).point

# Altera o sl

request = {

"action": mt5.TRADE_ACTION_SLTP,

"symbol": symbol,

"position": row["ticket"],

"volume": row["volume"],

"type": mt5.ORDER_TYPE_SELL,

"price": row["price"],

"sl": row["sl"] - difference,

"type_filling": filling_type,

"type_time": mt5.ORDER_TIME_GTC,

}

information = mt5.order_send(request)

print(information)

def verif_tsl():

if len(MT5.summary)>0:

buy_open_positions = MT5.summary.loc[MT5.summary["position"]==0]["symbol"]

sell_open_positions = MT5.summary.loc[MT5.summary["position"]==0]["symbol"]

else:

buy_open_positions = []

sell_open_positions = []

""" SE FECHAR UMA DAS POSIÇÃO É NECESSÁRIO DELETAR O PREÇO NO DICIONÁRIO DE PREÇO MAX E MIN """

if len(MT5.max_price) != len(buy_open_positions) and len(buy_open_positions) >0:

symbol_to_delete = []

for symbol in MT5.max_price.keys():

if symbol not in list(buy_open_positions):

symbol_to_delete.append(symbol)

for symbol in symbol_to_delete:

del MT5.max_price[symbol]

if len(MT5.min_price) != len(sell_open_positions) and len(sell_open_positions) >0:

symbol_to_delete = []

for symbol in MT5.min_price.keys():

if symbol not in list(sell_open_positions):

symbol_to_delete.append(symbol)

for symbol in symbol_to_delete:

del MT5.min_price[symbol]

if len(buy_open_positions) == 0:

MT5.max_price={}

if len(sell_open_positions) == 0:

MT5.min_price={}

def run(symbol, buy, sell, lot, pct_tp=0.02, pct_sl=0.01, comment="", magic=23400):

# Inicializa

mt5.initialize()

# Escolhe o símbolo

print("------------------------------------------------------------------")

print("Date: ", datetime.now().strftime("%Y-%m-%d %H:%M:%S"), "\tSYMBOL:", symbol)

# Inicializa

ouvertures = MT5.resume()

# Compra ou Vende

print(f"BUY: {buy} \t SELL: {sell}")

""" Fecha o trade eventualmente """

# Tipo de extração do preço

try:

position = ouvertures.loc[ouvertures["symbol"] == symbol].values[0][1]

identifier = ouvertures.loc[ouvertures["symbol"] == symbol].values[0][0]

except:

position = None

identifier = None

if position!=None:

print(f"POSITION: {position} \t ID: {identifier}")

# Verifica os trades

if buy == True and position == 0:

buy = False

elif buy == False and position == 0:

before = mt5.account_info().balance

res = MT5.send_order(symbol, lot, True, False, id_position=identifier,pct_tp=pct_tp, pct_sl=pct_sl, comment=" No specific comment", magic=0)

after = mt5.account_info().balance

print(f"CLOSE BUY POSITION: {res.comment}")

pct = np.round(100*(after-before)/before, 3)

if res.comment != "Request executed":

print("WARNINGS", res.comment)

elif sell == True and position == 1:

sell = False

elif sell == False and position == 1:

before = mt5.account_info().balance

res = MT5.send_order(symbol, lot, False, True, id_position=identifier,pct_tp=pct_tp, pct_sl=pct_sl, comment=" No specific comment", magic=0)

print(f"CLOSE SELL POSITION: {res.comment}")

after = mt5.account_info().balance

pct = np.round(100*(after-before)/before, 3)

if res.comment != "Request executed":

print("WARNINGS", res.comment)

else:

pass

""" Compra ou Vende """

if buy == True:

res = MT5.send_order(symbol, lot, True, False, id_position=None,pct_tp=pct_tp, pct_sl=pct_sl, comment=" No specific comment", magic=0)

print(f"OPEN BUY POSITION: {res.comment}")

if res.comment != "Request executed":

print("WARNINGS", res.comment)

if sell == True:

res = MT5.send_order(symbol, lot, False, True, id_position=None,pct_tp=pct_tp, pct_sl=pct_sl, comment=" No specific comment", magic=0)

print(f"OPEN SELL POSITION: {res.comment}")

if res.comment != "Request executed":

print("WARNINGS", res.comment)

print("------------------------------------------------------------------")

<pre></pre>

<pre>

</pre>

# Importa as bibliotecas

import talib as ta

import time

from datetime import datetime

import numpy as np

import pandas as pd

from algo_mt5 import *

import MetaTrader5 as mt5

mt5.initialize()

# Define o indicador (rsi)

def rsi(symbol):

overbuy = 70

oversell = 30

neutral = 50

df = MT5.get_data(symbol, 3500).dropna()

df["rsi"] = ta.RSI(df["close"], timeperiod=14)

today = df["rsi"].iloc[-1]

# Long buy signal

buy = (today > neutral) & (today < overbuy)

# Short selling signal

sell = (today < neutral) & (today > oversell)

return buy, sell

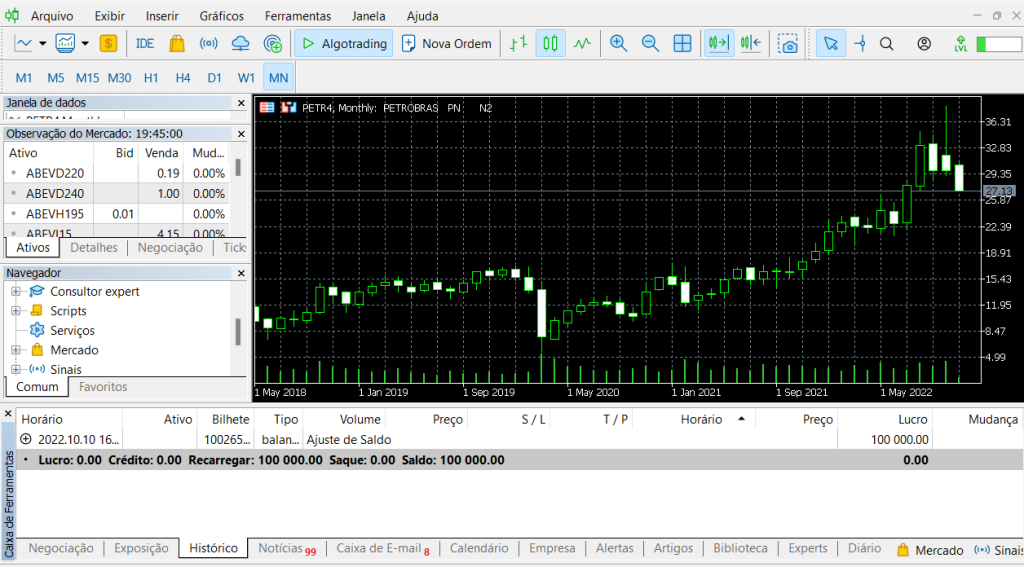

# Define os ativos financeiros

symbols_list = {

"Petrobras": ["PETR4", 1]}

# Constrói a mensagem

current_account_info = mt5.account_info()

print("------------------------------------------------------------------")

print(f"Login: {mt5.account_info().login} \tserver: {mt5.account_info().server}")

print(f"Date: {datetime.now().strftime('%Y-%m-%d %H:%M:%S')}")

print(f"Balance: {current_account_info.balance} USD, \t Equity: {current_account_info.equity} USD, \t Profit: {current_account_info.profit} USD")

print(f"Run time: {datetime.now().strftime('%Y-%m-%d %H:%M:%S')}")

print("------------------------------------------------------------------")

# Em qual dia e horário irá rodar o algortimo?

launching = [[0, "00:15:59"],

[0, "15:59:50"],

[1, "15:59:50"],

[2, "15:59:50"],

[3, "15:59:50"],

[4, "15:59:50"]]

# Lança o algoritmo

while True:

# TSL

MT5.trailing_stop_loss()

MT5.verif_tsl()

# Verficação para o lançamento

current_time = [datetime.now().weekday(), datetime.now().strftime("%H:%M:%S")]

if current_time in launching:

is_time = True

else:

is_time = False

# is_time=True # Apenas para rodar o trading AGORA

if is_time:

# Abre os trades

for asset in symbols_list.keys():

# Inicializa os inputs

symbol = symbols_list[asset][0]

lot = symbols_list[asset][1]

selected = mt5.symbol_select(symbol)

if not selected:

print(f"\nERROR - Failed to select '{symbol}' in MetaTrader 5 with error :",mt5.last_error())

else:

# Cria os sinais

buy, sell = rsi(symbol)

# Roda o algoritimo

MT5.run(symbol, buy, sell, lot, pct_tp=0.1, pct_sl=0.05)

______________________________________

Quer saber mais?

Veja nosso curso de Python para Investimentos.

________________________________

Referências

Inglese, Lucas. Python for Finance and Algorithmic trading (2nd edition): Machine Learning, Deep Learning, Time series Analysis, Risk and Portfolio Management for MetaTrader™5 Live Trading